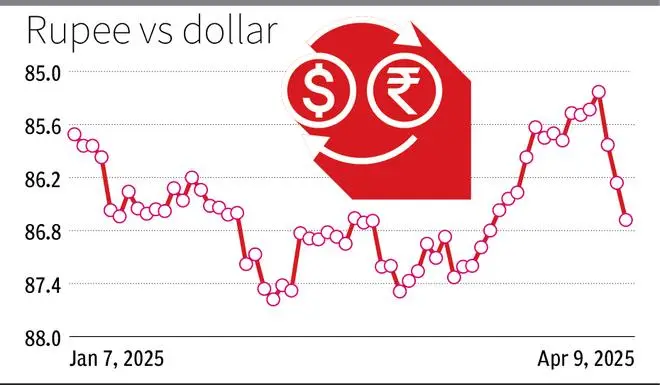

The rupee fell about 42 paise on Wednesday in sync with the depreciating Chinese currency amid escalating tariff war between US and China.

The Indian unit closed at 86.6875 per dollar against previous close of 86.2650. Intra-day, it hit a low/high of 86.71 (a three-week low)/86.40.

At the post-monetary policy press meet, RBI Governor Sanjay Malhotra said: “We do not try to manage or target any rate or band or level for the Indian rupee…I think the markets in India are quite deep, quite wide, and the market forces best know what the levels should be.

“Having said that, any excessive volatility, if it requires an intervention, we will not be found wanting. We will certainly intervene wherever it is required.”

Amit Pabari, MD, CR Forex Advisors, said that the rupee extended its losing streak for a fourth consecutive session, sliding toward the 86.71 mark, weighed down by a mix of global and domestic pressures.

“A key trigger was the Reserve Bank of India’s unexpected open market operation, which injected ₹20,000 crore into the banking system. This move altered the liquidity landscape and immediately pushed the rupee lower.

“Adding to the currency’s woes was the RBI’s rate cut, which narrowed the interest rate differential and reduced the attractiveness of Indian assets for foreign investors,” Pabari said.

Abhishek Goenka, Founder & CEO, IFA Global, observed that the rupee was weighed down by external headwinds, including a record-low Chinese yuan that has intensified depreciation pressures across Asian currencies.

Tariff impact

Meanwhile, fresh US tariffs on Chinese goods have heightened risk aversion, dampening demand for emerging market assets and raising concerns about spillovers on India’s trade.

“Despite the dollar softening against haven currencies like the yen and Swiss franc, its strength persists against Asian peers due to yuan volatility and geopolitical uncertainties. Sustained yuan weakness and global risk-off sentiment may keep the currency range-bound with a downside bias,” per Goenka’s assessment.

More Like This

Published on April 9, 2025

Leave a Comment