Key factors contributing to this turnaround include a drop in India’s inflation to 3.61%, a narrowing trade deficit of $14.05 billion, and solid fundraising activities by state-run enterprises and non-banking financial companies.

| Photo Credit:

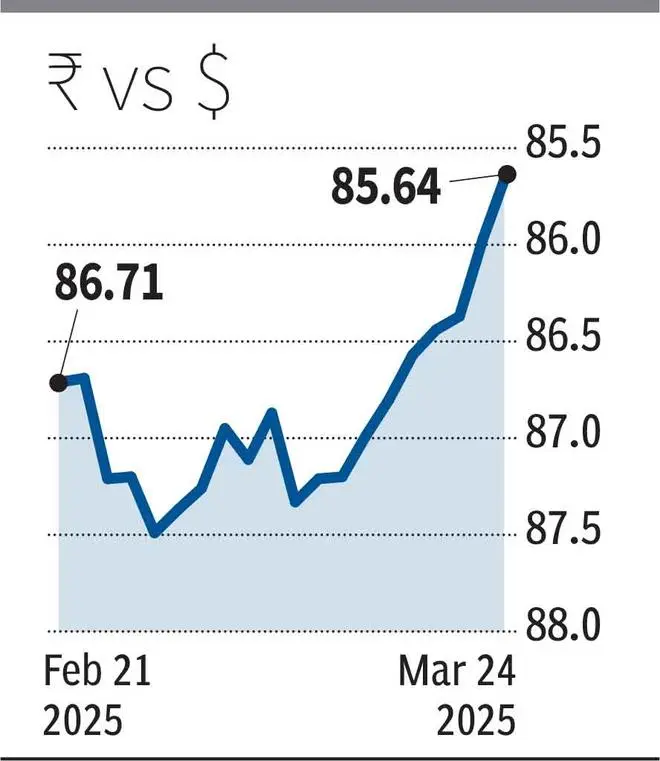

The rupee wiped off the current calendar year’s losses, appreciating continuously over the last nine trading sessions amid FPI-related inflows into debt and equity markets and the Dollar’s weakness against major global currencies.

The rupee closed at 85.6350 per US Dollar (USD), up about 35 paise from its previous close of 85.98.

In the last nine trading sessions, beginning March 11, 2025 (closing at 87.21), till date, the Indian unit has appreciated about 158 paise.

Amit Pabari, MD, CR Forex Advisors, said: “The Indian rupee has staged an impressive comeback, erasing all its losses for 2025. This surge was largely driven by strong foreign portfolio inflows, fueled by the FTSE March review and robust fundraising activity. Ri

“State-run enterprises raised ₹14,000 crore, while Indian states secured ₹40,100 crore through debt sales. Additionally, NBFCs issued ₹16,400 crore in bonds, boosting liquidity and reinforcing investor confidence—providing crucial support for the rupee’s appreciation.”

Adding to the positive momentum, India’s inflation dropped to 3.61%, comfortably below the RBI’s 4% target, emphasised Pabari. This pushed real yields to 3.06%, making Indian debt more attractive to foreign investors and triggering fresh capital inflows.

The trade deficit also narrowed to $14.05 billion—the lowest since September 2021—leading to a rare overall trade surplus of $4.5 billion.

V Rama Chandra Reddy, Head-Treasury, Karur Vysya Bank, said: “On the first trading day (April 2) of the current financial year, the rupee closed at 83.3850. Thereupon, it has been it has been secularly depreciating. The reasons for this at that time could be US Fed hiking the rates and Dollar strengthening.

“Around the time Trump was elected US President in November 2024, rupee was at 84-84.50 levels….Once he indicated harsher tariffs and immigration policies, the speed of rupee’s depreciation increased.”

He attributed the appreciation of the rupee in the last nine trading sessions to FPI-related inflows into debt, including external commercial borrowings. FPI inflows into the equity markets in the last couple of trading sessions also supported the rupee.

Pabari noted that the USD/INR pair recently broke decisively below 85.80 and could test strong support at the same level in the near term.

He assessed that a technical rebound from this level could push the pair back toward 86.50–86.60 in the short term.

However, if market conditions remain favourable, the rupee may continue strengthening, potentially moving toward 85.20 levels.

More Like This

Published on March 24, 2025

Leave a Comment