Adding to the optimism, US Treasury Secretary Scott Bessent hinted that India could become the first country to sign a trade deal with the US

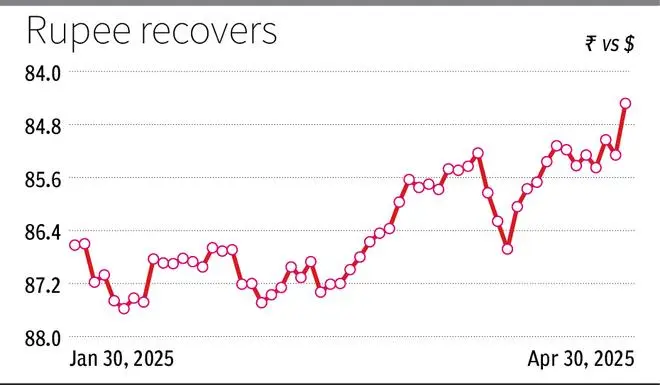

The rupee closed at its highest level in about five months on Wednesday, buoyed by a weak Dollar, easing crude oil prices and foreign investor inflows into the domestic equity markets.

This came even as tensions continued on the border between India and Pakistan, with the latter violating ceasefire along the line of control, and US continuing to stand its ground on tariffs.

The rupee, which opened stronger at 85.15, closed 76 paise stronger on Wednesday at 84.49 per USD against previous close of 85.25. This is the highest close since November 2024.

Positive undercurrents

Amit Pabari, MD, CR Forex Advisors, emphasised that amid the fog of regional tension, positive undercurrents have begun to surface.

“Foreign Institutional Investors (FIIs), lured by India’s attractive real yields and strong corporate earnings, have emerged as net buyers, pumping in over $3.4 billion over the last 10 sessions.

“This influx has provided some cushion for the rupee and signalled growing global faith in the India growth story,” he said.

Adding to the optimism, US Treasury Secretary Scott Bessent hinted that India could become the first country to sign a trade deal with the US.

“While still speculative, such a development would boost medium-term sentiment for the rupee and underscore India’s rising strategic importance,” opined Pabari.

Dilip Parmar, Senior Research Analyst, HDFC Securities, attributed the surge in the Indian currency to month-end adjustments and a technical sell-off in the US dollar leading up to the holiday.

Despite prevailing geopolitical tensions, trader caution was somewhat offset by the Reserve Bank of India’s apparent absence from the market and the strengthening of other Asian currencies, providing support to the rupee, he said.

Parmar is of the view that looking ahead, in the near term, the spot USDINR pair finds support around the 84.10 level and faces resistance near 85.50. The current bias appears to favour further strengthening of the rupee.

Published on April 30, 2025

Leave a Comment