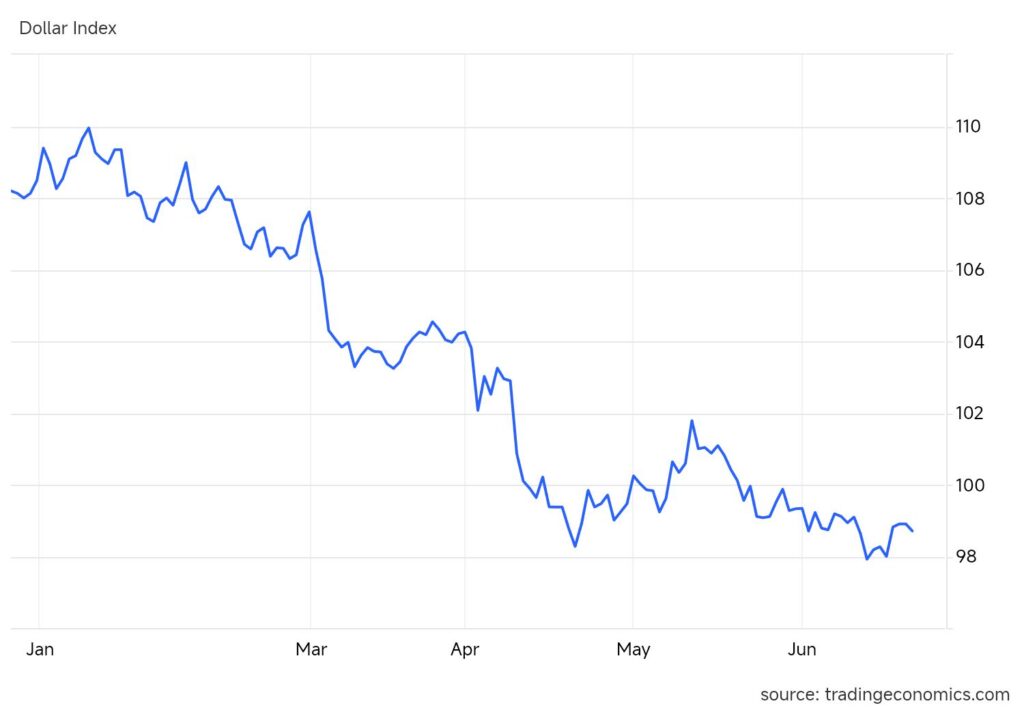

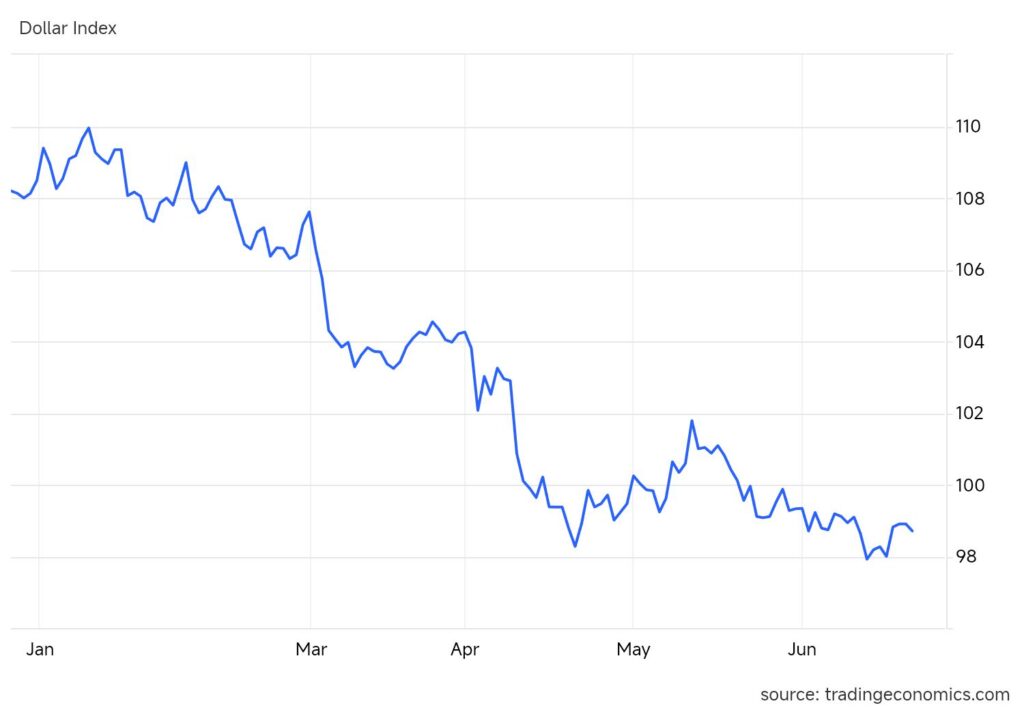

The U.S. Dollar Index plummeted to its lowest level in three years Thursday, sliding as low as 98.6, marking more than 9% decline from where it started the year, as investors reassess Federal Reserve monetary policy and global economic dynamics.

The DXY exchange rate fell to 98.7070 on June 20, 2025, down 0.20% from the previous session, continuing a sharp downward trajectory that has captured the attention of financial markets worldwide.

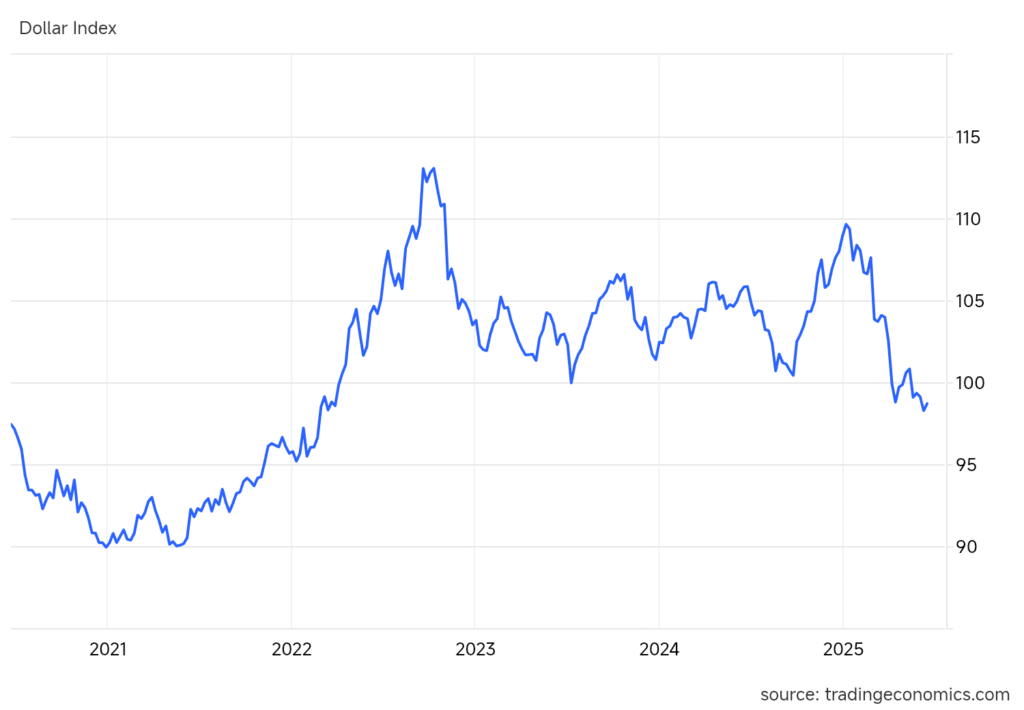

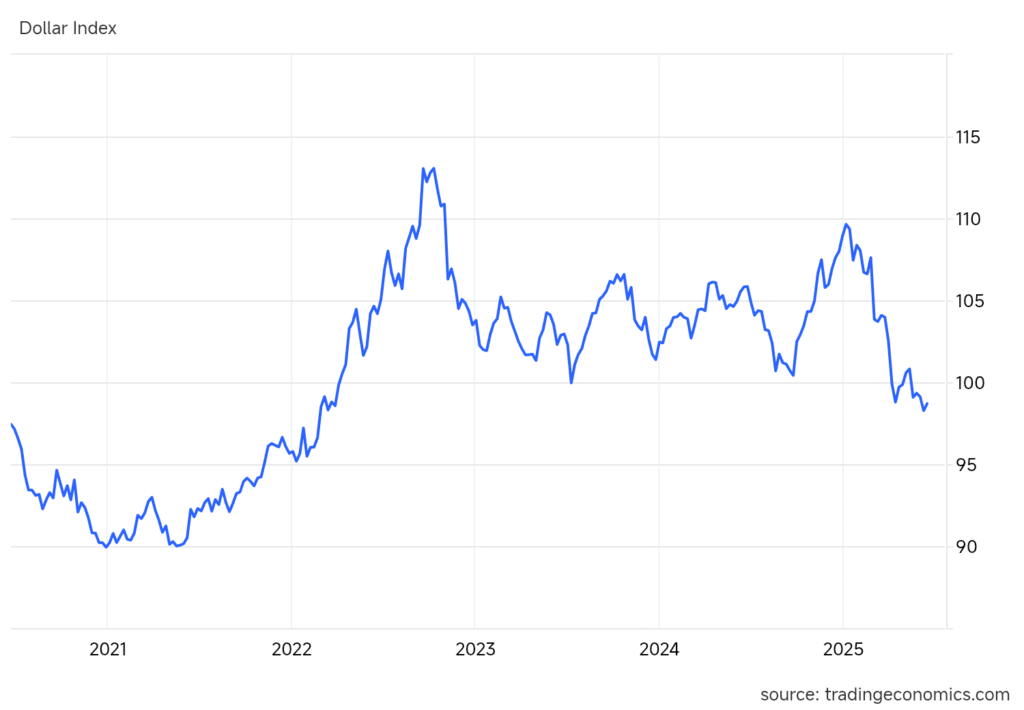

The index has only shed more than 9% of its value during the first half of the year two other times since 1985, with the last occurrence in 2002.

The dramatic decline comes just days after the Federal Reserve’s latest policy meeting, where officials maintained the benchmark rate at 4.25%-4.5% post-June meeting, monitoring inflation and labor data amid uncertainty.

The committee indicated through its closely watched “dot plot” that two cuts by the end of 2025 are still on the table, though it reduced expected cuts for 2026 and 2027.

Federal Reserve Chair Jerome Powell faces mounting pressure from multiple directions. Despite calls by the president for lower interest rates, the central bank kept borrowing costs steady to keep inflation in check, while simultaneously grappling with economic uncertainties stemming from international trade policies.

The dollar’s weakness has sparked intense debate among market analysts about its broader implications for global finance. Currently, the dollar is two standard deviations above its 50-year average, suggesting limited room for further appreciation, according to J.P. Morgan Asset Management research.

“The dollar has alternated between periods of strength and weakness historically,” said market strategists, noting that while a downturn was anticipated, the timing and magnitude have surprised many observers.

The decline has particularly significant implications for emerging markets and commodities, which typically benefit from dollar weakness. Cryptocurrency markets have also responded positively, with Bitcoin advocates pointing to the dollar’s devaluation as validation of alternative store-of-value arguments.

Over the past month, the United States Dollar has weakened 0.86%, and is down by 6.73% over the last 12 months, representing one of the most sustained periods of dollar weakness in recent memory.

Market participants are now closely watching upcoming economic data releases and Federal Reserve communications for signals about future policy direction. The central bank’s next scheduled meeting in July will likely provide crucial insights into whether the current dovish stance will continue.

International implications are already emerging, as a weaker dollar typically makes U.S. exports more competitive while increasing the cost of imports. This dynamic could influence ongoing trade discussions and global economic relationships.

The Federal Reserve’s challenge lies in balancing domestic economic concerns with the dollar’s role as the world’s primary reserve currency. Any significant weakening could have far-reaching consequences for global financial stability and international trade relationships.

Looking ahead, economists expect continued volatility as markets digest changing monetary policy expectations and geopolitical developments that could further influence dollar strength.

Leave a Comment