A major Bitcoin holder deposited 400 bitcoins worth $40.59 million to cryptocurrency exchange Binance on Saturday, continuing a 14-month selling spree that has netted the anonymous investor more than $625 million.

The wallet, tracked by blockchain analytics firm Lookonchain, has sold 6,900 bitcoins since April 2024 while retaining 3,100 bitcoins valued at $318.4 million. The sustained sell-off comes as Bitcoin trades near recent highs above $93,000, though the cryptocurrency has shown volatility in recent weeks.

Large cryptocurrency holders, known as “whales,” can significantly influence market prices due to the relatively illiquid nature of digital assets. This particular whale’s methodical approach of depositing bitcoins to Binance suggests a deliberate strategy to convert holdings to cash or other investments.

Bitcoin reached record highs earlier this year following the approval of exchange-traded funds tied to the cryptocurrency and a network event called “halving” that reduced the supply of new bitcoins. However, recent price action has shown signs of weakness, with analysts noting lower highs since June 18.

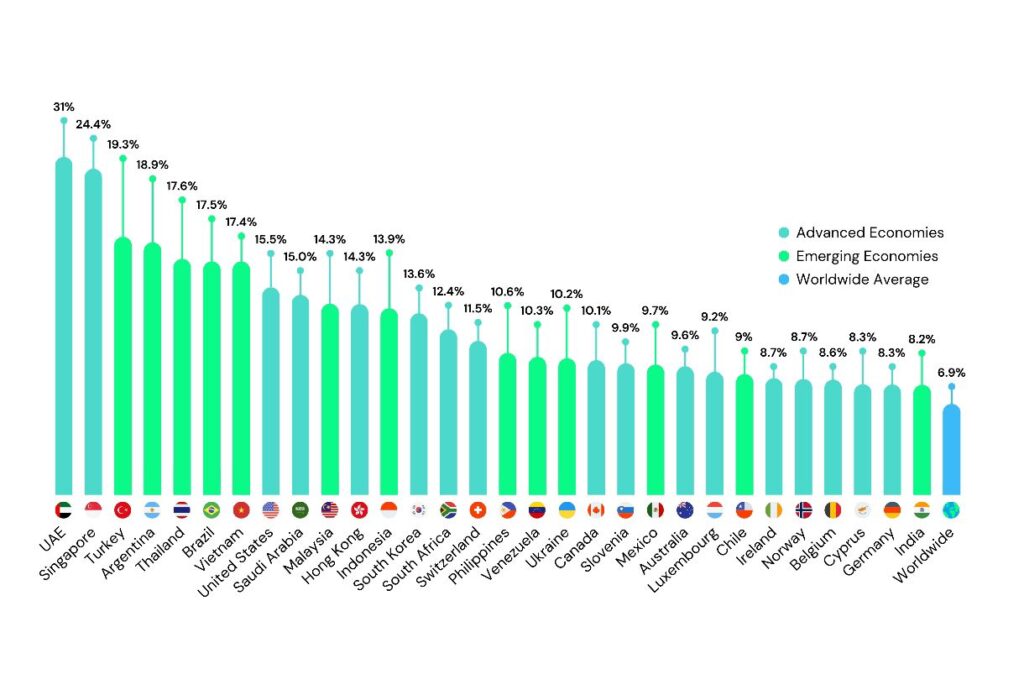

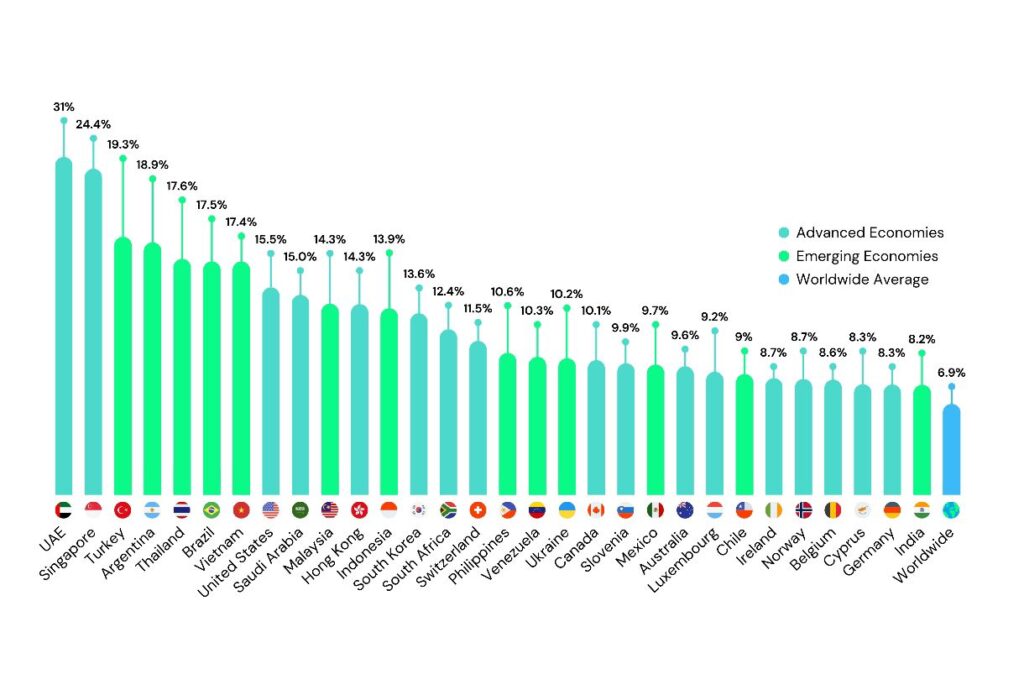

Cryptocurrency whales controlled 3.56% of all bitcoins in circulation as of August 2024, according to data provider BitInfoCharts. Research from the National Bureau of Economic Research found that significant sales by major holders often correlate with price drops of 5% to 10% within a week.

The whale’s remaining $318.4 million stake means additional sales could continue to pressure Bitcoin’s price. Market participants are monitoring the wallet for further activity as the cryptocurrency sector grapples with increased institutional adoption alongside concentrated ownership patterns.

Bitcoin has gained widespread acceptance in 2025, with over 560 million users worldwide holding cryptocurrencies as of 2024, according to research firm Triple-A. The approval of spot Bitcoin ETFs and the April halving event have provided fundamental support for higher prices.

Despite the whale’s ongoing sales, Bitcoin remains up substantially from levels seen in 2023, when it traded below $30,000 for extended periods. The cryptocurrency’s price has been supported by growing institutional investment and expectations of regulatory clarity in major markets.

The identity of the whale remains unknown, with only the wallet address “12d1e4” providing identification. Blockchain technology allows for transparent tracking of transactions while preserving user anonymity, enabling researchers to monitor large holders’ activities without revealing personal information.

Leave a Comment