A crypto whale on Hyperliquid suffered a $7.6 million loss on May 14, 2025, after shorting Bitcoin, Ethereum, and Solana with 5x leverage, as Ethereum surged past $2,700, underscoring the risks of high-stakes trading in a volatile market.

A trader known as a “whale” on the decentralized platform Hyperliquid saw a $3.5 million profit turn into a $7.6 million loss in a matter of days, according to blockchain analytics account Lookonchain.

The whale had been shorting Bitcoin, Ethereum, and Solana with 5x leverage since May 10, depositing a total of 62.4 million USDC to maintain the position. Ethereum’s price breaking above $2,700 on May 14 triggered the dramatic loss, as the market moved against the trader’s bet.

Hyperliquid, a platform known for supporting up to 50x leverage and instant transaction finality, has become a hub for high-risk traders. The whale’s strategy initially paid off, with a $3.5 million unrealized profit reported on May 13 when the market briefly dipped.

But Ethereum’s 8.08% rise in the last 24 hours, reaching $2,639.50 with a market cap of $318.66 billion, according to CoinMarketCap, flipped the position into a steep deficit. Despite the loss, the whale doubled down, adding 11.9 million USDC to the short, a move that has sparked debate among crypto observers.

“Sometimes you need to take the L,” said X user Web3withCJ, reflecting a sentiment shared by many who see the whale’s persistence as risky. Others, like user Pascal242127657, suggested a potential price correction could still favor the trader, stating, “It could work out for this whale.”

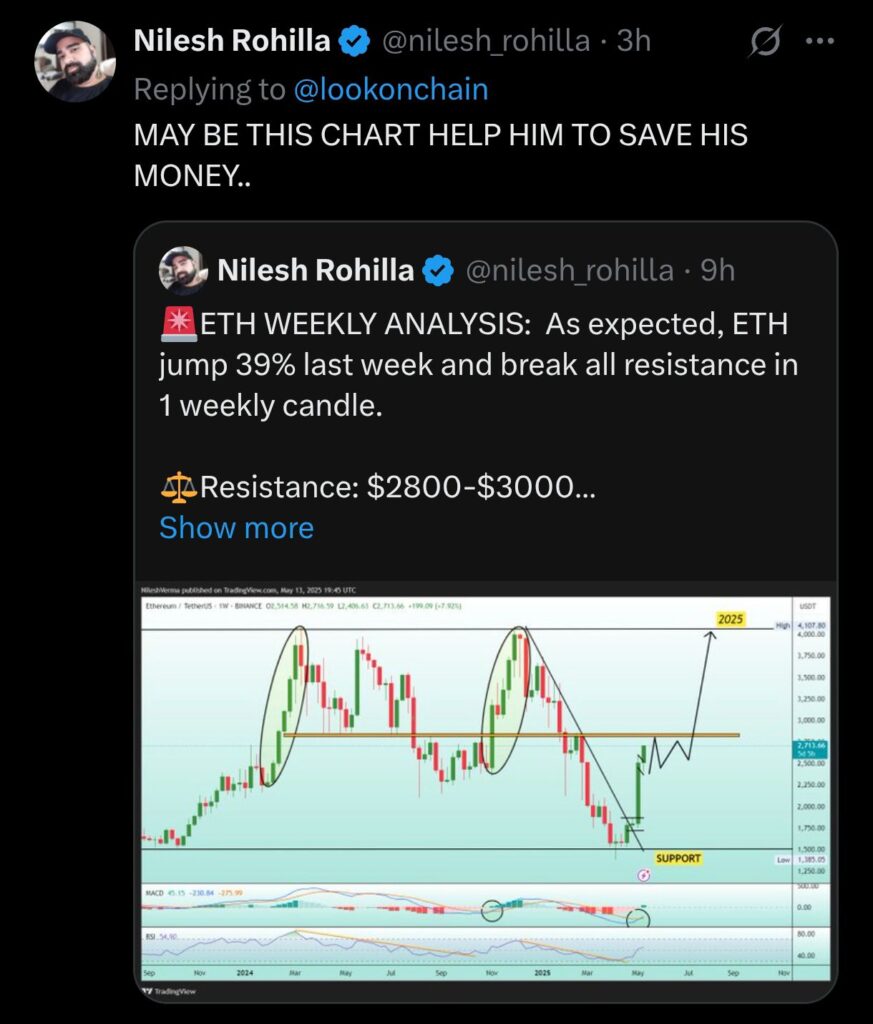

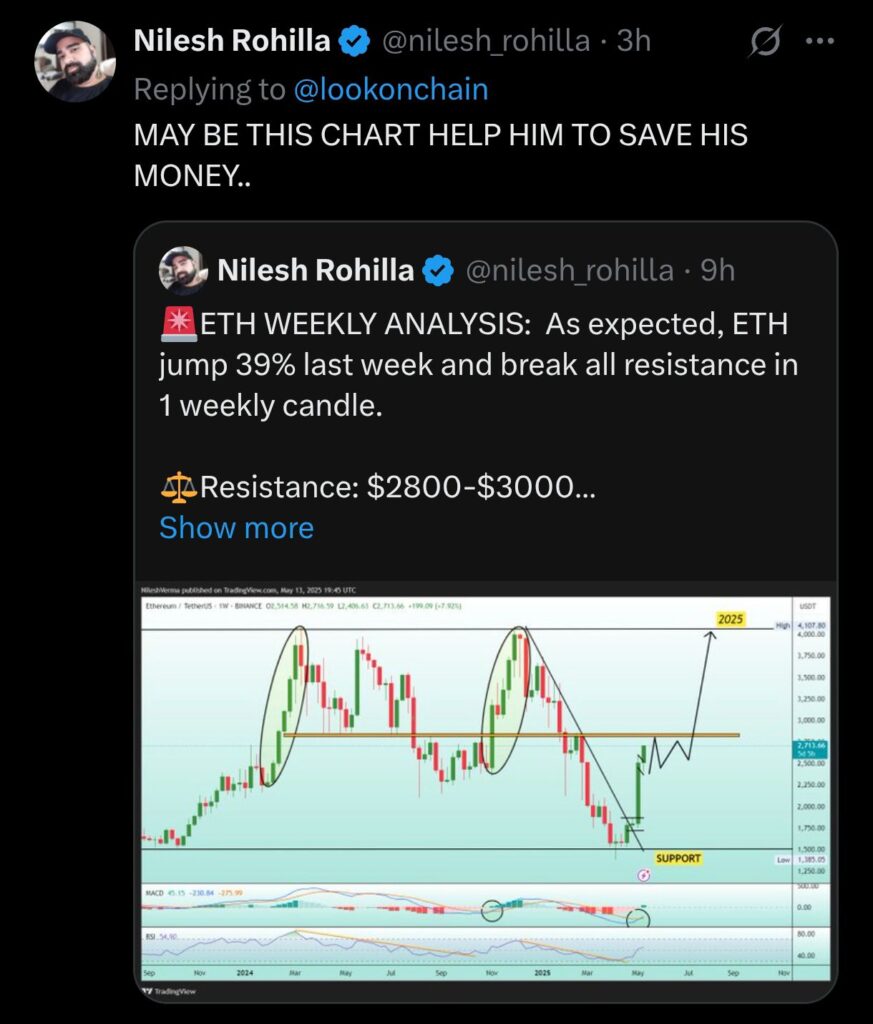

Market analyst Nilesh Rohilla, who noted Ethereum’s 39% weekly jump and predicted a rise to $4,000, warned that the whale’s position could face further pressure if bullish momentum continues.

The whale’s loss comes amid broader market trends, including increased institutional interest in Ethereum. Since late April 2025, Ethereum ETFs have seen inflows of 3,600 ETH, per , signaling growing confidence in the cryptocurrency.

This event highlights the double-edged nature of leveraged trading in DeFi, where platforms like Hyperliquid offer significant opportunities but also expose traders to rapid, amplified losses.

As the crypto market approaches a $2.66 trillion valuation, driven by retail and institutional participation, the whale’s predicament serves as a cautionary tale. Analysts are watching whether this high-profile loss will lead to a cascade of liquidations or if the trader’s bet against the market will eventually pay off. For now, the volatility of leveraged trading remains a stark reminder of the risks in the fast-evolving crypto space.

Leave a Comment